What is Backcasting?

Backcast’s name was inspired by a passion for fishing (where the backcast is the critical action that sets up the accuracy of the cast) and by its partnership investment approach.

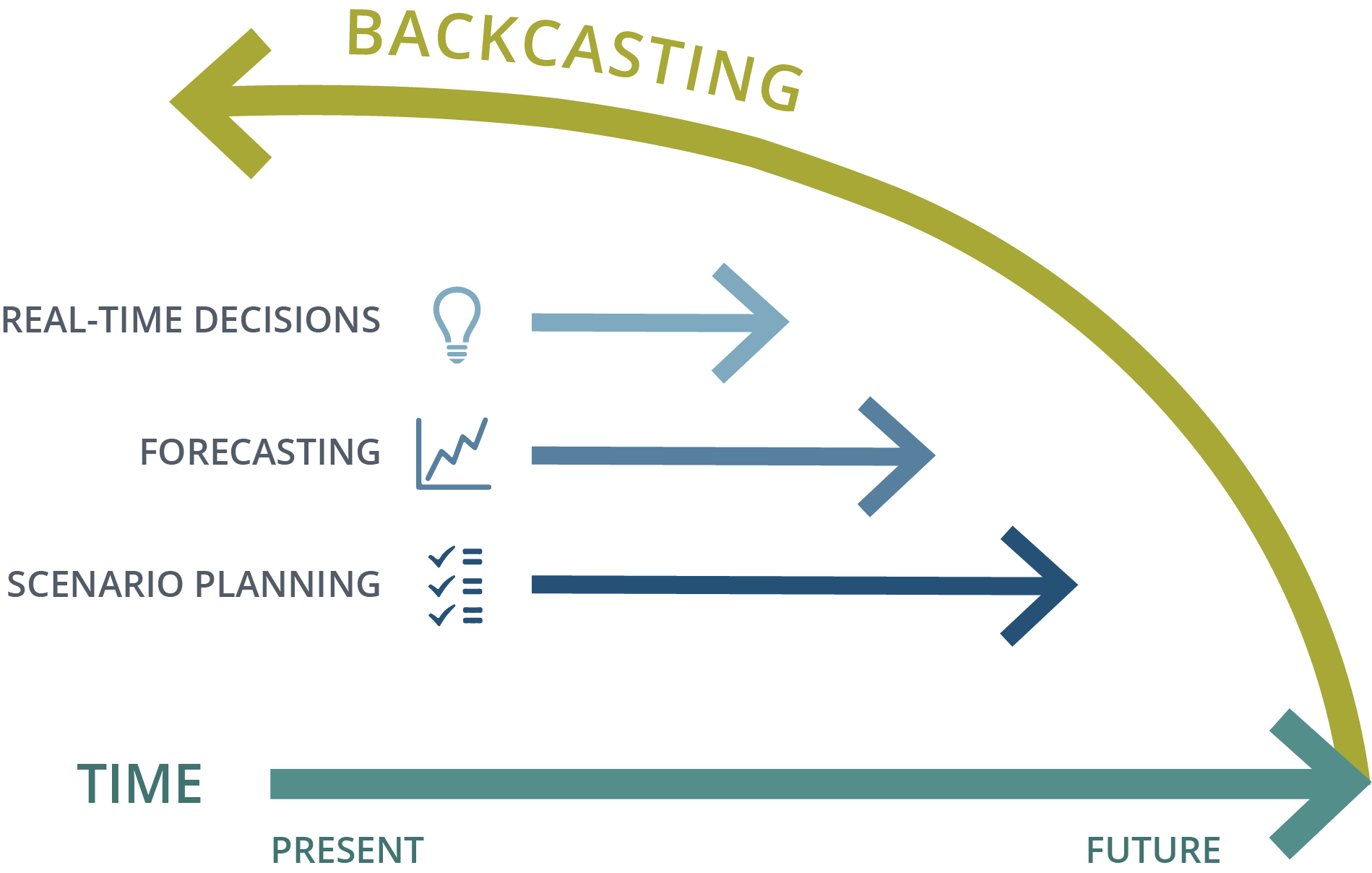

In finance, “Backcasting is a business planning method in which future desired conditions are envisioned and steps are then defined to attain those conditions, rather than taking steps that are merely a continuation of present methods extrapolated into the future. Simply stated, Backcasting is the opposite of forecasting*.”

Backcast works closely with management teams of its portfolio companies to understand the future they envision for their businesses, and works backwards from there. After careful listening, we seek to introduce our value-additive capabilities, including our highly flexible capital. Our network of more than 50 corporate operating partners is a roster of current and former senior operating executives from a vast array of industries. We believe that these operating partners serve as “bench strength” who can offer portfolio companies incremental resources. The value that Backcast offers to its partners is intended to extend beyond the duration of our flexible capital solutions.

Other financial firms lend, Backcast Partners.

*A method outlined by John B. Robinson at the University of Waterloo in 1990.